|

November 23, 2005

Posted at 01:04 AM

Comments (7)

|

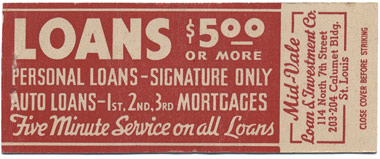

Had one of those phone calls today that just plain broke my heart. When I went back to school in the fall of 1998, I was lucky enough to get half of my tuition funded at the Minneapolis College of Art + Design with a hefty scholarship and some grants and shit. The rest of the balance was covered with student loans. The loans covered my remaining tuition, big city rent and some “general living expenses.” I signed on the dotted line and with a little sweat, got myself a big ol’ hi-falutin’ design degree. When I graduated a couple years later, my balance was $26,430. A hefty amount for any 27-year-old. I started paying right away on it, and in not time “consolidated” the thing down to a 20 year, $180 a month deal. I mean, shit, I had no choice. I got offered a much better rate and jumped at it. Okay, so now fast forward to 2005, some five years later. I’ve been a good customer. My little payment gets deducteed every month without so much as a whisper, and well, I pay $200 a month, just to throw a little extra cake at it, in hopes of reducing the long haul of payments. Today I thought I’d check in, and “see where I was at” in the overall scheme of things. I’m sad to say, that after five long years of paying the man, some $2400 bucks a year, on time and faithfully, my balance is at a disheartening $21, 905. My heart broke in two. I wanted to call it quits for a split second. So that means, I’ve paid $12,000 to “pay off” $4,500 of the balance. Awesome. I mean, shit, I knew what I was getting into, and, heard the horror stories, as well as a handful of, “best loan you’ll ever get” shit from colleagues. Fuck it. Fuck the payments. I’m just gonna work extra hard to pay the sonofabitch off, and fast. I’m getting nowhere, real fast, and man, drastic measures have to be taken to do some damage to that balance. Why I write this is, on some fleeting level, is that I hope to humanize the racket that this interest game is from my little corner of the Portland undergrowth. We all know it is, but, ya just “get busy living” and fall in with it, and get comfy, and well, just kinda live with it. I played by the rules, and feel so blindsided, or something. (I’m sure those reading this are doing a, “Ya should have known better.” headshake right now, and, so be it if ya are.) So, I’m gonna get busy paying this shit off once and for all. No more Mr. Dumbshit. Thought I’d share this with you. Got some insight on this one? Solutions? Tips? Tricks? War stories? Share ‘em in the comments section below, and hell, maybe they’ll help some of our “younger, eager readers,” before they get old and fucked like me. Maybe they’ll soothe my pain. Maybe not. There Are 7 Comments

if you dont go to school, you can avoid all that. That’s what I did, and look at me now! Posted by: coyle on 11/24/05 at 10:51 AM

I’ve been reading your site for awhile and this is the first time I’ve actually put in a comment. I spent a couple of years after university pretending I didn’t have a student loan but after a while decided there was no getting away from it. I paid $480 a month for five years working as a freelance theatre tech and that was five years of pain but worth it in the end to get rid of that boulder of debt. I still paid a criminal amount of interest on it but at least it was done. Oh well, just wanted to say hang tough and pay off as much as you can each month and one day it will be a distant memory. Just think you might not be doing what you’re doing now if it wasn’t for that loan and I wouldn’t have such a good time checking in on your website every couple of days. Thanks, Ian Patton Posted by: Ian Patton on 11/25/05 at 1:03 AM

HappyTDay, Post. Don’t know what your interest rate is but that’s pretty nuts. I can feel you though… me and AmEx are feuding on this exact thing. The best thing you can do is be diligent about your loans. The wife and I still have debt, you know, car, baby, etc., but we watch our credit card use closely and make a point of always paying as much as we can towards old loans. We live in an extremely expensive state in an extremely expensive town but manage to live on one income. That being said, we’ve paid virtually all of our school loans off, many for a number of years now, and many GREATER than what you have. We did this by taking a special interest in them. Over the past many years we’ve consolidated them into one loan, moved them between at least a dozen different cards - taking advantage of low rates for limited periods so we would be paying on the meat and not the fat - and raised extra funds to knock off big chunks when possible. We’ve both subsidized income by doing extra work, selling on ebay, and forgoing major expenses. If you’re a homeowner, which I believe you are, you should consider rolling your debt into a second mortgage or home equity loan and/or refinancing. It’s not uncommon to knock of years or get a healthy check back, which could be used to kill that loan. I’m no expert though… just talking out loud. If I were you, the first thing I’d check is rolling it into my current mortgage, consolidating everything. Then, I’d take on a few extra jobs with the single purpose of applying it towards those loans. Knock it down a bit. Get some immediate satisfaction in getting below $20k. Of course, if you increase your mortgage you’re also increasing the amount of your deductible for business, which might help at tax time. There’s a psychological effect in only having one loan/mortgage, you feel much more in control because you only write one check. That’s all I got brother. Posted by: Andrew R. Jenkins on 11/25/05 at 5:40 PM

I went to some shmancy college for a couple years under the impression my pops was going to cover it. At the time all I wanted to do was snowboard and he talked me into it. After a couple years I decided to enjoy my young life and live with a couple dirt bags and shred daily. Then I went pro and about the same time my father became unemployed and 10G’s became my problem. Luckily I started getting paychecks and my dirt bag lifestyle didn’t change for all the cash went to the loan. Just think. If I wouldn’t have gone to school, I could have turned pro a couple years earlier, got the Audi, a mortgage, the whole pro starter kit. Instead I’ve forgotten the majority of what I’ve learned, I have a few units towards whatever degree I may fall back on when I’m done gettin rad, and…. I’m done typing. Posted by: Robbie Sell on 11/25/05 at 8:33 PM

I just left the country. Fuck the U.S.A. and it’s criminal slavery system. If only you knew how the world really works this would come as no surprise. But the questions are rarely asked and the answers too hard to swallow. Good luck with your debt. They can pry mine from my cold dead fingers. B. Posted by: B. on 11/26/05 at 4:35 AM

Loans. What loans?

It’s all a big fucking joke. Invisible money. Imaginary bargaining. It’s capitalist corruption in it’s purest, most vile manifestation. We’re all just renting our lives from somebody until we croak. Posted by: ryno on 11/28/05 at 7:03 PM

Always happy to tell you something you already know: live econo, stop buying so many toys, and you’ll have that monkey off your back in no time. i poured all my “disposable” income into my student loans when i got a real job and paid off 15 G’s in under two years. that’s why i’m more punk than you. hb Posted by: Mr. Knowitall on 11/29/05 at 2:02 PM

Post a Comment

(you may use HTML tags for style)

Remember Me?

|